From Your First Customers To Where You Are Right Now

May 20, 2025

Hosted By

Dan Sullivan

Dan Sullivan

Jeffrey Madoff

Jeffrey Madoff

How did you land your first customers, and how did that shape your entrepreneurial journey? Dan Sullivan and Jeffrey Madoff share their origin stories, from life insurance referrals to fashion industry breakthroughs. They explain why longevity in business comes from curiosity, calculated risks, and a relentless focus on making your future bigger than your past.

Show Notes:

Thinking about your thinking is beneficial no matter who you are or what industry you’re in.

There’s no recipe for creativity.

Risk and excitement are two sides of the same coin—you can’t have growth without embracing both

The first person you have to sell an idea on is yourself.

If you have an advantage in a competitive industry, you won’t tell your competitors about it.

When experimenting with a new solution, you have to start by making sure it works for one person.

Longevity is something to be proud of.

If you have a successful approach, you can keep it, and just add more experience to it.

There are two types of support: moral and financial.

Longevity in business isn’t about luck; it’s about staying alert, curious, and adaptable to new opportunities.

Your number one job is to always make your future bigger than your past.

The more committed you are to something, the less you care about the obstacles.

Resources:

Thinking, Fast and Slow by Daniel Kahneman

Learn more about Jeffrey Madoff

Dan Sullivan and Strategic Coach®

Episode Transcript

Jeffrey Madoff: This is Jeffrey Madoff, and welcome to our podcast called Anything and Everything with my partner, Dan Sullivan.

Dan Sullivan: We were just discussing a topic, which when I said it, Jeff said, we got to talk about this topic. But it reminded me that it's a topic that virtually every entrepreneur likes to hear from other entrepreneurs. And that is, how did you get your first customers? How did you go from your first customers to where you are right now? So my story starts in 1974. When does your story start, Jeff?

Jeffrey Madoff: 1976.

Dan Sullivan: Yeah. And, you know, not to go into great detail, but I was a copywriter in a big ad agency in Toronto. BBDO was the global company, but it was the Toronto branch of BBDO. And I was a good enough writer that I could have probably made a career out of copywriting commercials, ads. Probably not a great writer, but would always be employable. Previous in my life, I had really, really enjoyed the activity of coaching other people on how they were thinking about things. It wasn't so much that I knew what their business was, it wasn't so much I knew you know, what their skills were, but we get them to think about how they were managing their time, what they were shooting for in terms of goals, what kind of activities they were doing that they were good at, what kind of activities they needed to have other people around them that were better than they were.

So I jumped out and probably by a lot of luck, I immediately got contracts, coaching contracts with individuals who were really, really top life insurance agents. And life insurance is a tough business to be good at because you're selling something that the benefit of it doesn't happen until the customer is dead, you know. You're talking about things, at that time, the life insurance industry was still controlled by big insurance companies. You were an agent, but you were an agent of a particular company. New York Life still is one of the huge ones, but you had Northwestern Mutual, you had Metropolitan, you know, you had a lot of big companies. There were actually over a thousand in the United States. But these were the top of the top, and they actually had a term for that called top of the table.

So they had one group of very, very good life insurance agents, which were called million-dollar roundtable. And then the top ones, probably the top 500 in the world, were top of the table. And that had just been created. And I hit it right at the creation of this concept and got three right off the bat and they were referred to each other. One would get me as a coach and he'd say, you know, this guy is really good. He'll get you really clear about what you're thinking about. And I went around, which was different from a lot of industries. If something works in one industry where it's very competitive retail, you won't tell your competitor that you're using someone who's helping you.

But life insurance was very different. The other thing is the reason why they were top life insurance agents was all their clients were successful entrepreneurs. And I really hit gold right there. And these were not life insurance agents, they were every other kind of business. And I said, you know, if I just get the top agents over the next 10 years, I'll get all their clients, which turned out to be true. And that's really the short story of a long journey. But it's just making sure it worked with one person who is really happy. They could see the benefit for their clients and customers and we build up.

So we've had pushing 25,000 entrepreneurs now who've been at Coach, right now we're about 3,000 active. And they come back, they'll pop out for a year or two years, they come back. I've had one over 33 years and he's in and out five times. He'll come in for a couple of years, go out for a year, come back, get focused again. And he takes jumps each time he comes back. So that's it.

Jeffrey Madoff: So was it a conscious thing? By the way, when you talked about, you know, life insurance is a tough sell because the benefits don't kick in ‘till after death. You know, it's kind of like religion, you know, the same kind of thing. You know, be a good person because when you die, you'll get the rewards in the afterlife. I'm more practical. I would like those rewards while I'm still living because I know I can feel them.

Dan Sullivan: Yeah, it's really interesting. One of my top agents back then, he discovered something and he'd meet with a potential client and he'd say, do you love your wife? And the guy said, not really. He said, do you love your children? He said, not really. He said, do you love your employees? No, not really. Do you love your reputation for being a good husband, a good father, and a good employer? He says, yes. He says, we'll insure that. You only insure what you love. Really good life insurance agents, tremendous psychologists.

Jeffrey Madoff: Yeah. I mean, don't you think anybody that's selling something successfully is good at reading people?

Dan Sullivan: Could be, but insurance agents really deal with fundamental life and death issues in a way that a lot of businesses don't.

Jeffrey Madoff: Now, so it happened in your case. Did it just happen that it was life insurance, or was that just serendipity? It happened to be life insurance, and you figured out how to parlay that?

Dan Sullivan: That had happened, I don't think it would have mattered, you know, what kind of business it was. That had happened as fast as it did was because of life insurance, because back in the seventies and eighties, they were the meatiness people. They'd have study groups, they would have professional associations, they would have company meetings, and they would talk and talk and talk about how they were getting where they were, and my name came up. So I think it was an unusually unique and powerful networking industry that I happened where they didn't see each other as competitors.

Jeffrey Madoff: Hmm. But don't you think with your ambition and resourcefulness and savvy, no matter who that first client would have been, you would have been somehow building a business out of it?

Dan Sullivan: Sure. Yeah. Yeah. Well, I wouldn't have stopped at failure.

Jeffrey Madoff: Right. Right.

Dan Sullivan: No, I mean, once I jumped out from the ad agency, this was a good, you know, I was 30 and I was pretty set. Whatever it takes, however long it takes, I'm going to make a go of this.

Jeffrey Madoff: Yeah. I mean, my story. There's an interesting transition in the sense that I had moved to New York. I had closed my first clothing company because my backer had made it clear to me, in a very fair and good way, by the way, and he said that, you know, I'm backing you because you provide employment for Wisconsinites. And, you know, I had about 120 people working for me. And he said, if you ever move the business, because I know this business is centered in New York, I won't continue to back you. And, you know, he set his terms and that was fair. I understood his reason why.

And when I moved to New York, because I always figured, you know, money comes and goes, time only goes. And certainly as I get older, I also am fascinated in a linguistic sense of the parallels between time and money. You know, in business, we all hear that time is money. Well, not really. You know, it's not really that. But, you know, you spend time, you spend money, you save time, you save money, all of that kind of thing.

So when I moved to New York and I started another business after a year of traveling the world, because I'd saved up enough to do that if I lived frugally, which I did, I had a great time. And one of the fabric companies that I used to buy from, Erlanger Blumgart, and Mr. Erlanger was a really good guy. And he said to me, do you know anything about the movie business? I said, not really. No, I mean, I read books about film because I'm fascinated by it. I love it. But do I really know anything about it? Not really. He says, well, you got a good head on your shoulders. You know business. My son is your age. He's gotten involved with some people. Would you mind meeting him? He doesn't listen to me at all. But you're a contemporary. He might. Sure, I'd be happy to meet him.

And his son, Tommy, had optioned William Burroughs' book. William Burroughs, for our listeners who don't know who that is, was one of the seminal figures of the Beat Generation and the scion of the Burroughs’s business machine. His father was tremendously wealthy. I mean, I met William, he was in his early sixties at that point. And they were going to make a film based on his book called Junkie that was being directed by Dennis Hopper. And Dennis was staying at Tommy's house. So I met Dennis. That was the second person involved that I met. He and I hit it off. He wanted me to be in the movie, which was kind of cool until it became clear this was never happening.

Dan Sullivan: But anyhow. I like the New York texture of this podcast. You could hear the sirens in the background.

Jeffrey Madoff: Yes. I call that the New York symphony. You know, that's what it is. When I call my friends as I'm walking around the city, they go, okay, I don't know. It's been five minutes. I haven't heard a siren. What's going on? So that was the beginning of my transition to the film business. I had sold my second clothing company. And so, you know, making that exit. And because of this meeting, which is somewhat totally serendipitous, I ended up getting into film production. And because of my background in film, I knew that, number one, there was an opportunity in videoing fashion shows, because that wasn't happening before. And I knew the language, even though, you know, I didn't have a big business. I knew all the problems big companies were having. It's just, you know, mine had lower dollar amounts attached to it, but it's the same thing.

So it happened that I got into doing fashion videos. which led to music videos, but I deliberately went after and fortunately got clients like Radio City Music Hall, the Harvard School of Public Health, different businesses outside of that. Basically for my own edification, because I wanted to do more than one kind of business. I wanted to tell more than one kind of story. But the way that it started was total coincidence, but it just happened to make a really nice transition from one to the other. And I was able to parlay my knowledge of fashion into merging that with my knowledge of what I was learning about film, because I knew that before I was doing that, nobody was videoing fashion shows. So the designers would just rely on their employees to tell them what it was like.

And my first client was Halston and then Ralph Lauren. So not a bad way to start off. And that got me, that kind of marketed me. I could get meetings just about any place because I had two of the most visible designers, famous designers as clients. And I'm proud to say, like you are, I'm proud to say that I worked with Halston until he stopped working. And Ralph Lauren was a client for 36 years until I decided I didn't want to do that anymore. And like you, I'm very proud of that longevity, which I think is something to be proud of.

Dan Sullivan: Here's a question for you. What is the approach you're taking today that you have a long success record of taking this approach, but you had the approach right at the beginning? You've just added more experience to the approach. It's sort of like a structure in a process. But you've just added a lot of different kinds of experience to check out, is this always true? You know, that's what you do. It's sort of scientific. Does it work here? Does it work there? Does it work there? If it works everywhere, you know, you've got sort of an axiomatic, this is true. Can you think of something that was there right from the beginning?

Jeffrey Madoff: Yeah, I think that the through line is that I've always gone after things that I found interesting and that I enjoyed, and that the primary concern was not that I could make a lot of money doing this. The primary concern is, is this how I want to spend my time? Is this what I want to do? What else could I be doing?

Dan Sullivan: Yeah. Like creating a Broadway potential play.

Jeffrey Madoff: That's right. Did I have any idea that was going to happen?

Dan Sullivan: Oh, that's a money-maker.

Jeffrey Madoff: Yeah. Right.

Dan Sullivan: I remember our first conversation. You almost tried to dissuade us.

Jeffrey Madoff: Yeah.

Dan Sullivan: Yeah, not really. I mean, we were very, very positive, but you said there's two types of support. One is moral support, which of course I appreciate, but the other one is I'm actually looking for dollars here.

Jeffrey Madoff: That's true. That's right. And you and Babs were kind and generous and believed in it enough to do it. But, you know, it's funny because we're just waiting for the next funding round.

Jeffrey Madoff: I don't ask until I need. And I don't need until I ask, you know? And it's interesting, you know, the way my teaching, which I did for 16 years at Parsons School of Design in New York, came about was I was a guest lecturer, really enjoyed doing it and interacting with the students and having them, you know, challenge with questions and each week coming up with an agenda that would benefit them and be interesting to me. You know, frankly, the way yours and my relationship has evolved, starting off, you know, we were in a couple of meals together. But as we got to know each other and realized that we had a lot of shared interests, and traits such as, you know, interest in thoughtful conversation, curious about how things work, not just the things we knew, and all of those sort of things.

And that's been the really steady thing in my life because I had a tremendous financial opportunity when I was probably 25 about 20 years ago. Yeah, I was 20, 25 or so. And I won't go into the whole story, but I was asked to take over buying American businesses for this German firm that I had done business with. And because of what I had gone through with those people, it's just not, I didn't want to do it. And, you know, I was offered a lot of money and a car and, you know, moving, you know, they did finance my way into my previous apartment and that sort of thing. But, you know, it ended up that's just not what I wanted to do, and I didn't accept the position. But I think that it's so important. I can't justify spending the majority of my time doing things that I'm not interested in, no matter how much it pays me. I'm just not able to do that.

Dan Sullivan: Yeah, it's really, really interesting. People, I'm really very conscious of entrepreneurial longevity these days, simply because I'm experiencing it myself. And I notice that people who are very successful, who bail out at a certain point, they say, that's it, I'm not going to do that anymore. And then it becomes leisure, their interest in leisure, or their interest in philanthropy, or something like that. And one of the things I noticed, the ones who have the great longevity is they're alert, curious, and they're very, very responsive to new learning experiences and new business experience. And they're very resourceful in shifting how they do what they do to something new. And that seems to be a very fundamental internal driver of them forward.

And the other thing is I noticed is that they never talk about their age very much. They never talk about, whoa, boy, that year really went by fast. And I said, I don't know, the more interested I get in more things, it seems to slow things down. It doesn't really speed things up. And what I'm doing today is more interesting than anything I did in the past. So there's an improvement that's taking place. I sense that about you too. I don't sense any world weariness about anything that you're involved with.

Jeffrey Madoff: No, because most of the things that I'm doing now, I wasn't doing those things 10 years ago.

Dan Sullivan: But there's an improvement to the things that you're doing. How do you mean improvement? Well, one is not looking at it from the inside, but just looking at it from the outside. You're in your seventies. You're across halfway to 80. And the project that you're doing, the play, is bound now for the West End of London, you know, which is one of the two greatest theater markets in the world, and it's a big deal. You know, I've seen the play six times, I've invested at each funding round, and it seems to get bigger and bigger, and who you're coming into contact with, you know, your contacts with very famous corporations now are very interested in entertainment now, who are taking a really a deep look at what you're doing here because they're saying this might be a new big thing for us. That usually doesn't happen to people in their 70s.

Jeffrey Madoff: Yeah, you know, I am aware this is maybe where there's a difference between us in the sense that I'm very aware how fast time is going. That isn't anything that is making me feel I'm desperate, but it makes me feel like I can't believe how fast time is going. You know, it just, years clip by quickly. And, you know, I think that when you enjoy what it is you're doing, in the moment, like when I've been up writing our book, when I'm really in that zone, four hours, five hours can pass. And, you know, it could have been 15 minutes. You know, it felt like that. I love that level of being totally mentally and emotionally immersed and producing stuff. That's, that's a lot of that. It's creative.

Dan Sullivan: And I think that's the aspect of creativity. I think creativity has its own time zone.

Jeffrey Madoff: Oh, you're right. You're right. And there's no recipe for getting it. You got to find out what works best for you, you know, and you know, another thing that's great is that you're very supportive about the effort. And, you know, co-authoring something together can be a very bumpy, rocky road. This is my first at co-authoring, but I think that we both are mature enough to know the dance steps, you know, as you're getting things from me and I'm getting things from you, you know, the synchronicity that happens, and it's not like we got to know each other just before this project started. You recognized something that you thought we could build and set up the conditions that that could happen.

Dan Sullivan: Yeah. Well, an aspect of that is that you had vast connections in a world that I don't know. Okay. The theater world, the fashion world. And I know a lot of entrepreneurs and a lot of different businesses, but I don't really go into their businesses. I have established what's common for all businesses. I've established a certain, it's almost like an entrepreneurial geometry. You know, if you want to build this and have it stand up, you gotta, you know, nature only supports right angles. So, you know, you got to make sure that things are solid and everything like that.

But just to pick the type of interviews that you're doing for this book, you know, I have no access to those individuals and I have no access to the, what I would say, the commitment that your interviewers are making to really help your side of the book. I mean, they're really, really interested in helping you and they're giving you very valuable material. And I couldn't have, there's no way I could have had access to that world except through you.

Jeffrey Madoff: But isn't it fun, the joint discovery that happens?

Dan Sullivan: Yeah, yeah.

Jeffrey Madoff: And I feel good about the fact that the people that I've met and gotten to know over the years, like Kathy Ireland, that, you know, asking her to do this. She's making the time to do it. And so many of the, not only generous people that I have actually had direct contact with, some I have met through others who have said set up an introduction.

Dan Sullivan: You gotta talk to so-and-so.

Jeffrey Madoff: Yeah, exactly. And then some, like the one that I was just telling you about before we started recording, this professor whose specialty is storytelling and what makes a good story, and she's, you know, nationally renowned. Will I get her? I don't know, but I'm going to reach out. You know, it's so interesting. So many times I've been in situations, whether we're talking about the concert that we're going to be doing in London and you know, casting a star in that position just cause it's, it's basically a marketing thing doing this concert or, you know, with the book and somebody that you ought to talk to and somebody say, well, I don't know if you can get to them. They might be, wait a minute, where I'm at right now is I don't have them. So I'm either going to stay in the same place or better the position.

Dan Sullivan: Yeah.

Jeffrey Madoff: So, none of this speculation makes any difference, you know? And it was one of the things that Lloyd Price used to always say, which was, the sure way to make sure nothing happens is to do nothing. So if you're just fret about, well, do you think they'd take my call? Do you think they'd, you know, all that kind of thing, find out. You're not gonna be any worse off than you are right now. And I have found ignorance is a solid foundation.

Dan Sullivan: Yeah.

Jeffrey Madoff: And oftentimes unshakable.

Dan Sullivan: Yeah. Yeah. Yeah. One of my phrases, people say, well, what if it doesn't work? And I said, we won't know less.

Jeffrey Madoff: That's right. It's the same thing. Exactly right. We will not know less.

Dan Sullivan: We'll know more. Yeah.

Jeffrey Madoff: Yeah. And there's an excitement that comes along with who we got.

Dan Sullivan: Yeah. You know, the other thing about it, and this goes, I think, to the general theme of what we're talking about here, is that there's a coin for improvement, and one side of the coin is excitement, and the other side of the coin is risk. And you don't get one side unless you have the other side. They have to have equal portions. And one of the things, and I'm answering my own question here, why do they drop out? They don't want the risk anymore. That means that they're not getting the excitement anymore.

Jeffrey Madoff: Right. That's right. Which has the potential to be useful when, if I'm seeking investment. But it's also sometimes people just shut off. They're like, across the board, done.

Dan Sullivan: And you know what I find invariably, it's who they've surrounded themselves by at this point in life.

Jeffrey Madoff: And who, what is that?

Dan Sullivan: That they're not with risk takers anymore. Everybody's hunkering down for security right now, don't wanna change anything, don't be doing that.

Jeffrey Madoff: Well, so many of those people, the kinds of risks that we're talking about, would have no effect on their lifestyle at all. And I have had people that have approached me for investment, and the first thing that if they respond about, well, how risky is this? I say, if you're looking for a sure thing, this is not it. If you're looking for an exciting ride and a lot of enjoyment along the way, and you can talk to any of the people that have invested, I think that you'd enjoy that. But if your concern is you don't wanna take the risk, I don't wanna try to talk you into it. I respect that. Go with God. But I'm not gonna try to convince you.

And with you, I mean, you and Babs were very willing, but with you or nobody else did I ever do any hard sell. Because I don't think you can. You know, the kind of people I'm approaching, they don't want to be sold. And I don't like selling, but I can be really excited about the story I'm telling you, and I think communicate that excitement. And I think that's important to be able to do.

You know, I had a different way of phrasing it, but one of your insights was the double sale. And which, you know, I love that because I was saying that to my students 16 years ago. First, you got to sell yourself on the idea because if you're not excited about it, how can you expect anybody else to be excited about it? And it was interesting to me I said, you're not ready to pitch this yet, if the first thing you're talking about are the obstacles that you have, as opposed to the excitement and willingness to overcome those obstacles.

Dan Sullivan: Yeah, one of the things that I've learned and painfully I've learned this is that I tend to talk about new ideas out loud, you know, like me too. And I find that you got to be very, very careful when it comes to team members, especially members of my company, and that they don't understand that talking about ideas doesn't mean that you're committing to the ideas. For them, if Dan talks about a new idea, that goes on their list of something they're going to have to do. And I found this was very dangerous.

So I created a little form, which you've experienced on this project called the Fast Filter. And I said, if Dan hasn't sent you this sheet of paper, or there's an electronic version of it, if Dan hasn't sent you this, and he's talking about something, you can just ignore him. Don't do it rudely, don't do it in an insulting way, but you don't pay any attention. But if you get this form, and it comes to you, Dan sold on this 100% and we're going to do it, and it's clarified a lot of problems in my company. On the other hand, more and more, I keep quiet until I'm ready to send the form. So I've learned it in two ways.

Jeffrey Madoff: Yeah, it's interesting. I've gone through my own version of that. You know, because to me, that free and open exchange of ideas is exciting.

Dan Sullivan: It's good for a podcast.

Jeffrey Madoff: Yes. Yeah. But you can also rattle people who their job is to get things done for you. And all of a sudden they're feeling barraged by something. I didn't even know about this. And it's well, it's not really ...

Dan Sullivan: No, we're just talking.

Jeffrey Madoff: That's right.

Dan Sullivan: There is no such thing as just talking in a lot of …

Jeffrey Madoff: That's right.

Dan Sullivan: Yeah, yeah, it's very interesting. The question I asked you, you know, what was true about you at the beginning? What was true about you at the beginning that's still going strong is the reason why there's no ending.

Jeffrey Madoff: What do you mean by ending?

Dan Sullivan: Well, we haven't retired, you know, we haven't retired. We're doing our most exciting projects now, not earlier in our career. I was really struck and it kind of surprised me that Daniel Kahneman, you know, Daniel Kahneman, he committed suicide on January 28th. And it was an elaborate preparation. It was a whole project to go to Switzerland where they have laws and assistance. Canada is another place. Canada is a good place to commit suicide. Anyway, and I've been following that because I read his book, Thinking, Fast and Slow. And he was a big, enormous influence. He had enormous influence. He had an enormous audience.

And I just found it really struck me. He was 90. He was 90. But I've been following it. It was the front page in the review section of The Wall Street Journal about three weeks, and they said this is very, very disturbing to a lot of people who, you know, who followed him over the years and, you know, took guidance from him and everything. So I've been doing a lot of AI searches on it, but he hasn't really done anything for about the last 15 or 20 years. He was very famous. You know, those books came out several decades ago in his thinking on this. And I just wondered if he ran out of ideas. And I have to tell you, I don't think anybody understands suicide. It's one thing that most people can't comprehend, you know, and everything like that. But it's a piece of useful information that I use.

When do I notice that someone doesn't have any excitement anymore, doesn't have any, you know, and I'm not attributing this to him at all because it's a special case, but he was very famous and, you know, and he did it, but it's an enormous reaction to this on the various publications and people said, you know, what's this say about human life and everything else? And I said, you know, it's not really understandable what goes on inside of another person when they decide to do it. I can understand extreme pain, unbearable pain. I can understand it. But he didn't have any of those symptoms, according to the friends and family that he knew. But my feeling is, you know, we've talked about this several times on our podcast. Your number one job is always make your future bigger than your past.

Jeffrey Madoff: Yeah, and you know, Daniel Kahneman had a partner, Amos Tversky, and …

Dan Sullivan: He died.

Jeffrey Madoff: Yeah, many years ago. He died in like 2004, so when Kahneman won …

Dan Sullivan: 31 years.

Jeffrey Madoff: Yeah, he, Kahneman

Dan Sullivan: 21 years, yeah.

Jeffrey Madoff: Yes, and Kahneman, he got the Nobel Prize, and they don't give it posthumously, so Tversky didn't get it. You know, I think that there's also a thing you're saying like pain, that's one thing. Another thing is fear of future. And that can manifest many ways. That fear of the future could be that you have contracted what will eventually be a completely debilitating illness. And that you will inevitably, despite whatever your intentions are, become a burden to your family and you are no longer able to live the life that you want.

And there are things that, a dear friend of mine committed suicide. And the first time he attempted it, the reason it didn't happen, as he told me, as he was getting on the chair and putting the noose around his neck, there was somebody pounding on the front door, and it was a friend of his. It would have been impolite to do that, yes, at that moment. But about two years later, it happened. His sister had committed suicide and their father committed suicide. There are and they don't know, you know. Why is that? That's not uncommon, by the way, that there is suicide in the family. So I don't pretend to know these things, but I know.

Dan Sullivan: It's a subject that I have, because I've never had the thought, you know, I mean, not that I've led a particularly negative or unhappy life, but I've never, I've never, I mean, you know, I had my famous divorce and bankruptcy day, and I noticed that it didn't bother anybody else. You know, I was the only one. So, you know, this is my deal. I have to take care of it and everything like that. But it's an interesting thing because it's being recommended in Canada that the government will help you commit suicide. And I think it has to do with they just don't want to pay for elderly people. They'd like to get elderly people out of the system, you know.

Jeffrey Madoff: But I also think along with that, it can all coupled with that can be the fact of the debilitating expense on surviving family members. You know, there's not going to be a good outcome. So if there's not going to be a good outcome, and it's only going to get worse, is that the quality of life you want while you're still sentient? if you've expressed your wishes to do that and you feel like you are protecting your family and you don't want to go through the inevitable route that that will take you. You know, God, I never want to be there. But I do have an understanding.

I've had another very dear friend that committed suicide quite a bit younger. But I mean, the one friend was in his fifties. The other one was in his very early forties and not unhappy people. You know, both of them I knew for quite a while. But it's also, you just really don't know people sometimes. And I think that's one of those things that it's really hard to comprehend. Because a lot of times people would say, did the person seem depressed? No, they didn't seem depressed. Or you didn't recognize it and they had grown very adept at masking it.

Dan Sullivan: Yeah, my big thing is to, because I've had a theme in my life, it goes back at least 40 years, always make sure that what lies ahead is bigger than what you've been through. And that's a muscle that I've built in my brain. So there's always the big thing lies ahead. The big thing doesn't lie behind. And that has an effect on your health, too. That has an effect on, you know, how you take care of yourself. It has an effect on how you handle your money and everything like that.

Jeffrey Madoff: Yeah, you know, it's interesting because my wife, Margaret, will talk about things and I said, but, you know, this hasn't happened yet. Why are you putting yourself through that? You know, and he goes, I don't have to prepare for good news. And I thought that was a very interesting statement. You can surprise me with good news. I don't want to be surprised with bad news. And there's a wisdom in that. But it's just my makeup is just different. I think that's true.

Dan Sullivan: You know, I remember 2016, I was diagnosed with prostate cancer. And there were a number of our team members, especially, that we talked about. And one of them said to me, you don't seem scared at all about this. And I said, my biggest concern is that I'll miss a workshop, that we gotta handle this in a way that I don't miss a workshop. I said, gotta make the workshop, like that. And it wasn't near death type of situation. We caught it in time and I got a great doctor. But my whole concern was I've made a commitment to have workshops. It was 30 days later and I gave a complete workshop and nobody noticed, nobody in the, I hadn't told any clients that I had just gone through a cancer operation. And I said, what matters is that they have a great workshop.

Jeffrey Madoff: When Cary Grant died, he was backstage and he was going to be doing a play. And he had a stroke. And it was quite bad. And he said, I'm so sorry. I don't want to disappoint the audience. Something to that effect. Now, my mom, who is very close to, when she was going into the hospital for surgery, and I was on one side of the gurney, my Aunt Ida was on the other side. My Aunt Ida was a tough piece of gristle, as they say. And she looked at my mom and said, Lily, I'm not concerned about you one bit. And my mom said, Ida, if I was standing where you are and you were laying where I am, I wouldn't be concerned either.

Yeah, you know, what happened, a real inciting incident for me was when we were in lockdown for COVID and there was no live production business going on. And it was not clear when, if ever, it would be going on, you know, during those early days, you know, we could be out of commission for, it ended up almost a year and a half, but it could have been, you know, longer, might've been two months, nobody knew, right? But what I did know was I'm gonna be in a rebuilding phase once this lifts. And so what do I wanna do? And what do I wanna do with my time? And my mantra became, if not now, when?

So that if not now, when applied to putting all my energy into the play and moving that forward and making that happen—you know, it was funny, we had a meeting the other day with this management company. We're going through a series of those now for finding people in the UK and we were talking about that and they said, well, you know, the likelihood of getting space at Southbank Centre and then getting a venue on the West End, I mean, it's, you know, the odds are really against you. I mean, that's just really, really tough. And I said, the odds of me talking to you about my play opening in London and the fact that we've made it this far has beaten all of those odds. So I don't care if the odds are tough. What can we do? What are the actions we can take to move this forward?

And, you know, I think the more committed you are to something, the less you care, and I'm not doing this foolishly at all, but the less you care about the obstacles, because there's always, when aren't there obstacles? There's always obstacles. There's always stuff you gotta deal with. And so I just believe that when I was thinking about, so what do I, do I wanna rebuild my production business? Do I wanna find a new office space? Do I wanna staff up again? No, because there's nothing that I haven't done other than make a feature film. There was nothing that I hadn't done in my business that I wanted to do.

So to your point earlier in our talk, to me it was about, I didn't think about it, but I love the way that you put it, making my future bigger than my past. I didn't think about it that way. I was just thinking about this is new and exciting. And you happen to be correct. Yes, it is bigger than anything I've ever done, but it's that too. And if it wasn't the, exciting part. And if I wasn't seduced by the idea of doing it, you know, that was the thing. But COVID was really a point of transition and that mantra of, if not now, when? And that's where that's the only time really that so far, that's the only time that I'm conscious of my age is, you know, that I know it takes a lot of effort, a lot of time, but would I have changed anything? No.

I mean, you know, are there different decisions I might've made at certain junctures just strategically? Yeah, probably. But the idea of doing something again, being seduced by the idea and trying to do it. And it gets real simple too. I mean, I remember I'd say to somebody said, did you talk to so-and-so, some decision we needed. They'd say, well, you know, they haven't called back yet. I said, wait a minute. They haven't called back yet, then you call them. I don't want to be a pest. It's not about being a pest. It's about moving this enterprise forward. You call them. And it's really interesting, even in little ways, it's like the death by a thousand cuts. You know, I think that's why, by the way, the Nike Just Do It slogan is the best that's ever been invented because it has so many layers of meaning. And it's that, it's just don't ruminate about stuff that you can actually move forward by just doing it. Because what's all that marinating in your anxiety gonna do for you? Nothing.

Dan Sullivan: Yeah, the interesting thing here is about decisions. And I tell people, you know, decisions are really good because the word from Latin, decidere, means to kill off the alternative. And I said, the first thing you have to do is when you are, people talk about, well, choice. I make choices. I don't make decisions. And I says, choices means that there's still alternatives. You know, I'm choosing this one, but I'm not giving up on that one either. I said, no, you have to kill the others off. And when I say kill them off is the alternatives don't have access to your brain anymore. Yeah, okay. Your brain is just, if there is a possibility in the world that you're going to do this and it's going to be successful, give all your energy to that. Don't give any energy to anything else.

Jeffrey Madoff: Yeah, you're right. And it's, again, things get jargonized. When you really look at it, what's the difference between the choice that you want to make and the decision you want to make? You know, you can make a choice not to make a decision, I guess, which is called procrastination. And sometimes that can be valuable.

Dan Sullivan: Oh yeah. Well, it's a decision. You just say, I'm putting it off to here. That's a decision. But I've had people who I can tell they're up against something. My experience is that it's never business and it's never economical. It's always social. it has to do with their relationships with somebody, okay? And I said, you know, one person, he had this great technological breakthrough, told us all about it, and I think I said this on a previous podcast, he told us about it, it was in the area of science and medicine, and so 90 days later, he comes back for his next Coach workshop, and he's not saying anything, and I says, wait a minute, you got everybody in the room excited. You had investors, if you had wanted investors, that were in this room who would have, you know, written you checks. Now there's nothing. And he said, no, it's really complicated. I said, okay.

Comes back next 90 days. I said, let's have lunch. And I said, can I make a stab at what's stopping you from going forward? And he said, sure. And I said, she can get half of everything up until now, but she doesn't get half of the new future. He says, yeah. I said, how long have you known this? And he said, 17 years. So I said, okay, it's a year from now, and you haven't done anything. Is that okay with you? And he said, no. I said, six months. You haven't done anything. I got him down to 90 days. And he said, okay, I'll do it. And five days later, he sent her the divorce papers.

Jeffrey Madoff: And you say you're not a therapist.

Dan Sullivan: I'm not a therapist. I just want to see what's going on. I just want to see what's going on in his brain, you know. I want him to see what's going on in his brain. Which is what a therapist does.

Jeffrey Madoff: And by the way, I say that with respect, not being snide at all. I think that in your domain, what makes you so good at what you do are the questions that you ask and get your clients to think about. And that's what it is. There's no good therapist either that just gives you answers. That's not a good therapist. It's how do you think about what you're thinking about? And even setting up the parameters. Six months, 90 days, you know, because then you're making him accountable for an action. And are you going to be accountable for that action? Or are you just going to tell me the same bullshit next time we get together?

Dan Sullivan: Well, he wasn't telling me any bullshit. He was just, well, I guess he was, he said, there's complications, but I always find that it comes back to, you know, for example, we have two sets of sales team. We have the get them into the Program salespeople, and we have the keep them in the Program salespeople. And then we have a second set of salesmen who bring them back into the Program if they've left the Program. But I tell them, if they say, workshop after workshop, they come in, they're in their first year, and they're gangbusters, they're doing what the Program suggests they can do, and they're getting great success, and they come to the first year, because we always renew at the end of each year, you know, there's no five-year renewals or anything like that.

Every year we face them with the fact that they have to make a decision and they have to write another check. It's good for them and it's good for us. So I said, if everything is working with the Program, their business is really growing, they're enjoying it, they're talking great story, and they say they don't want to come back, it's always social. And that is that their growth, their sudden growth, is making the people they live with uncomfortable. And they're deciding not to make their relationships uncomfortable because of their growth. They're making a decision between their relationships and their growth.

And I said, now, you pointing this out may not get them to come back, but you ought to at least tell them what the issue is. Their business has nothing to do with the coaching program. It has to do with the people whose opinion matters most to them don't want them to grow anymore. And I said, it's gonna happen. And I said, they're gonna make the decision, you know, and sometimes they come back five years from now and they said, I should never have left. And I said, but at least face them with what the issue really is.

Jeffrey Madoff: Yeah, you know, it's tough because also it's important to communicate to those most important. If there's going to be an impact on your life, you know, as opposed to playing that close to the vest with the people that are most affected by you in your life, a spouse or children who have grown up, whatever it is, that discussion should be had with them. Because a lot of times they'll build up a whole notion of what they think it's gonna be, what the response is gonna be, but they actually don't even know that. So where we started off was how you started off your clientele and insurance and finance. If you would have started off your business coaching writers, do you think you would have been successful? Or do you think this path was the only one you'd be successful at?

Dan Sullivan: Looking back, this was a great way to start. I'll say that because I had other people who were in different professions who, you know, thrived on the Program and that, but they didn't have that networking effect. The, you know, we, I went to a top of the table meeting. I was invited by one of my original and I got 31 signups on one day. And I came back and usually, you know, we'd get two or three signups. I would talk somewhere two or three, ‘cause it was a big check, you know, and I came and I had him in a briefcase and I said, I got one. And they said, oh, that's great. And I got another one by the time I hit eight. And I said, I got 31 and this is my sales team. This is the biggest sales day that any salesperson ever had in the history of the company.

But the thing is that we really grill people that they're really serious about the Program. We spend a lot of time asking them what they're going to do with the Program, why the Program makes a difference, is there any conflicts they have in their life. And this is just from experience where people have had those things and it's caused a problem. Yeah, so.

Jeffrey Madoff: But do you think no matter what, whether it was starting off with the insurance group and then knock on business you got from them, I guess the question is, was that the only thing you think you would have been successful at? Or do you think anything you would have tackled, being who you are, you'd have found a way to be successful in that pursuit?

Dan Sullivan: Probably. Yeah. Yeah. Yeah. But I'm happy the way it went. I mean, I caught something that was very early and it's making coaching entrepreneurs—you know, part of the sale back then was what was an entrepreneurial coach? You know, nobody really know what it was. So, you know, and I think that for people who were doing it in 1974, I'm the only one still doing it.

Jeffrey Madoff: Hmm. That's great.

Dan Sullivan: Yeah. Yeah. So this is really good. This was a very rich conversation. The whole, why do entrepreneurs do what they do? How do they do it? That is my current quarterly book is called The Bill of Rights Economy. And I'm showing how the first 10 amendments to the constitution unusually support entrepreneurism, you know, and very interesting because who are the people who put the constitution together? They all had businesses of one kind. I mean, they, you know, they, for the most part, some were lawyers, but they were still, they still had to run a business. You know, a big risk. Those guys took a big risk. They did. And we're still at risk.

Jeffrey Madoff: It's a work in process.

Dan Sullivan: Oh, yeah. The Constitution, if you really get down to it, it creates a lot of chaos.

Jeffrey Madoff: Well, true. That's why there's so many lawyers involved.

Dan Sullivan: No, I think it's reason because guns and lawyers. More or less for the same reason.

Jeffrey Madoff: Yes. Was that a rock group?

Dan Sullivan: Oh, no, that was Guns N' Roses. I have a client in San Diego. He's Israeli, actually South African, but then he became an Israeli. And he's really big on guns. After the October 7th, he had all these Jewish friends over in San Diego who wanted to learn how to fire a gun. And he said, got the name for it. We're going to call it Guns N' Moses. We had people signing up and, you know, basic safety and everything like that, you know. Always with a sense of humor, though.

Jeffrey Madoff: Thanks for joining us today on our show, Anything and Everything. If you enjoyed it, please share it with a friend. For more about me and my work, visit acreativecareer.com and madoffproductions.com. To learn more about Dan and Strategic Coach, visit strategiccoach.com.

Related Content

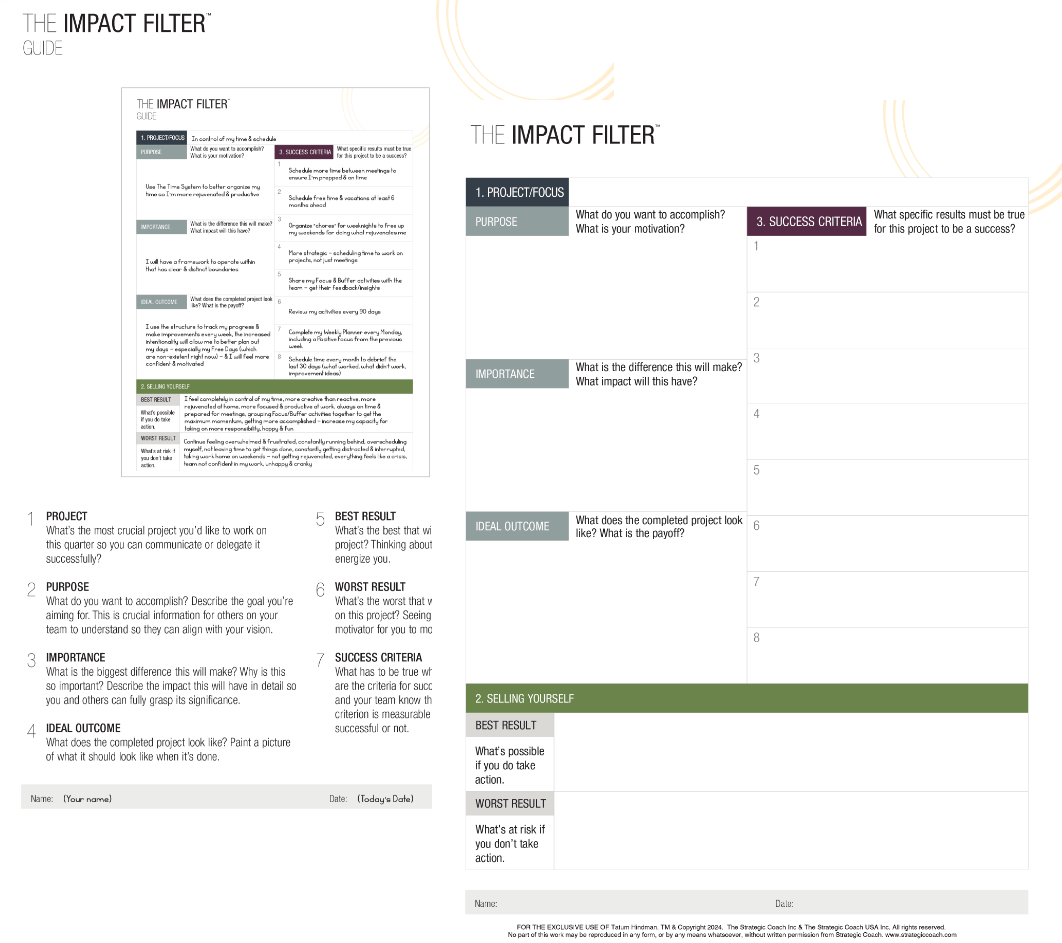

The Impact Filter

Dan Sullivan’s #1 Thinking Tool

Are you tired of feeling overwhelmed by your goals? The Impact Filter™ is a powerful planning tool that can help you find clarity and focus. It’s a thinking process that filters out everything except the impact you want to have, and it’s the same tool that Dan Sullivan uses in every meeting.