Rewind: How To Protect What’s Yours, with Keegan Caldwell

September 02, 2025

Hosted By

Dan Sullivan

Dan Sullivan

Steve Krein

Steve Krein

The importance of intellectual property is undeniable, but not everyone knows as much about their own IP situation as they should. Dan Sullivan and Steve Krein chat with Keegan Caldwell, the founder of an intellectual property law firm, who explains how IP law can benefit entrepreneurs beyond just protecting their creations.

Show Notes:

- An entrepreneur’s mindset is crucial because that’s what determines their behavior.

- Never fall in love with your creation until check writers fall in love with your creation.

- There’s value in long-term growth companies, but they need to have the revenue to support their plans.

- If you have a concept or idea that’s differentiating you in the marketplace, you likely have some IP that's worth discussing and protecting.

- In addition to protecting your innovation, IP can be used to create licensing and fundraising opportunities to drive up value for an IPO or an acquisition.

- Many companies don’t even think about intellectual property issues until they’re some ways down the road.

- One way to show you really believe in a technology you’ve created is to take the initiative to protect it.

Resources:

Who Not How by Dan Sullivan and Ben Hardy

How To Live To 156 by Dan Sullivan

The Gap And The Gain by Dan Sullivan and Ben Hardy

Episode Transcript

Steven Krein: Hello, welcome to the Free Zone podcast. This is Steven Krein from StartUp Health. I'm here with my podcast partner, Dan Sullivan from Strategic Coach. And we are now about to record with Keegan Caldwell, one of my fellow Free Zoners that has a really unique business, really unique background. Keegan's one of the world's foremost experts on intellectual property and is now running one of the fastest, if not the fastest growing intellectual property law firm in the country. And so I'm excited to hear an answer to the question of, Keegan, who is your target customer or client? And I want to actually go with ideal customer or client who really should be and will be talking to you tomorrow.

Keegan Caldwell: Our ideal client is generally at a stage where they've started to fully develop their concepts and ideas and know what their products are. Some of our clients have experience with IP, some of them don't. That's not the most important thing, but it's good if they know a little bit about the value of it and they're willing to explore that. The flip side of that is it's also important that they're able to trust our advice, right?

Steven Krein: But if somebody was to actually just look at a checklist of like six or eight things, what would be on that checklist to see if they are a fit for talking to you?

Dan Sullivan: Well, it's two things, that they would want to do it, but also that Keegan would want to do it.

Steven Krein: Yes, yes, yes. That's right.

Keegan Caldwell: Yeah, exactly. Perfect fit client, right, Dan? Yeah. I mean, somewhat joking, the ideal client that we have has money to spend on IP, right? That said, we definitely have a lot of unique finance arrangements with companies that we believe in as well, that are on a trajectory that we're able to offset some of those expenses. And we have a specific program that we're unrolling called Caldwell Startup, which is a new kind of division of our website that's focused just on early stage startups and providing low cost tools for them to get to the point where we can be of the most use, which is typically around post-seed pre-A, or somewhere in there is where we have usually a tremendous amount of value because we can help to accelerate the company by using the IP as an asset to help them accomplish business objectives.

Now that's not the easy checklist that you're looking for. So the key things are everyone is a potential candidate because if they have a concept or an idea that is giving them some differentiation in the market, then they likely have some IP that's worth discussing protecting, right? And whether or not you pursue formal protection or keep it internally, it's worth having a conversation, that's valuable to us. We want someone that can rely on us to be their Who, right? And so, you know, in the concept of Who Not How, we want to be able to be the Who, we want people to be able to rely on us for our, whatever advice it is that we're giving.

Candidates will also be people that are open to the idea of using the IP to create opportunities for whatever objectives it is that they have, right? So what I mean specifically is a lot of times people have these preconceived ideas that they just want the piece of paper to protect their innovation, but we want to be able to use the IP to create licensing opportunities, to create fundraising opportunities, to drive up value for an IPO or an acquisition. We want to be able to do those things, right? But at its core, we just need an entrepreneur that has a differentiating idea and is willing to listen to the advice that we have.

Steven Krein: I'm going to see if I'm going to repeat back what I heard and how I might explain it to my companies and StartUp Health, which is any entrepreneur with a startup who's raised seed financing should have at the very least a discovery session with you to understand what it is they might have or do have or should have that would be important as early as the very beginning when they've kind of put the company together, started work on the product. If an entrepreneur believes or thinks they have a unique differentiator, it'd be really nice to know from the very beginning what would be important for them to know.

So I'd say for any of our companies, if you're in StartUp Health, you need to talk to Keegan and at least in your Caldwell startup division, have a discovery session or discovery tool to understand the landscape of what they need to know about intellectual property. Because a lot of companies don't even think about it or talk about it or think they should talk about it until down the road. So, I love the cloud and just getting it through as simple as that.

Dan Sullivan: What really strikes me, Keegan, is that the mindset is really crucial because the mindset predicts the behavior. And my sense is that a lot of people fall in love with their creation. They fall in love with their innovation. And I'm in the constant startup business because our long-term clients like to revisit oldies but goodies, but they want new things all the time. And so I'm generating new concepts, new thinking tools all the time. And I've got a rule, I never fall in love with my creation until the check writers fall in love with my creation.

So I try to keep it very, very depersonalized, the creation. And when I go into a new setting, a new workshop with new ideas, I can only be prepared 50% because the other 50% is going to come from the response. So would you talk about something that immediately tells you that this person is not ready? Two or three things right off the bat. And one of them, I think, is that they're enamored of their own creativity.

Keegan Caldwell: Yeah, this is actually a great point, Dan. And we have the good fortune and opportunity of we've been working for several years with an incubator that's part of MIT. So it's called MIT Sandbox. It's their own kind of fund that is internal at the university. And we've been advising students there for, I don't know, three, four years now. We have attorneys that go there once a week or once every two weeks from our firm to go over there. I'm bringing this up because these are some of the most brilliant engineers, you know, by educational training on the planet.

But what often happens is you have these people that sometimes the technology is so bleeding edge that the market value for it, it doesn't exist. And it might not exist for, you know, 25 years or something like that. And it's not that it's not a great idea, but I think that just like the tools that we create at our law firm that add value for folks, or however an entrepreneur is approaching their innovations, there needs to be some sort of immediate market value and that they can accomplish their overall longer-term objectives. And Steve probably sees this all the time, where there's someone that they're so smart, they've got the most brilliant idea and they're so bright and they've got the best future, but they're so focused on something that is too far off that like they can't generate any revenue from day one or even having a shot of being able to do that.

And there's absolutely value in these long-term growth companies, but only if you have the revenue to be able to support that from day one. And so it has to be something that's going to be adopted or that has the chance to be adopted and that people can give some time and thought and consideration to that. And then I think that when you're an entrepreneur, and especially as we talk about technology, that the same thing almost has to be true, though, that you have to contemplate the business value and then contemplate the engineering value.

Steven Krein: What's the biggest aha or breakthrough people have in the first session with you or your attorneys? When you think about somebody walks in blissfully ignorant about their IP, what's the big mind-blowing thing? And I'm just going to give you an example. When I went into my first Strategic Coach session, The Lifetime Extender was that for me. I was 28 years old, being asked, how old am I going to be when I die? What's my life look like? All that was like mind-blowing and I left a transformed person. Is there a transformation, maybe not as life-changing as that, but is there a transformation that occurs in one session with your clients or prospective clients that you would say is like that secret moment?

Keegan Caldwell: Yeah, I think so. This is a nice low-ball question for me. Thanks, Steve. So, I think the key thing that the feedback that we … like 90% of our phone calls that we have, like when people get off, especially in almost all the cases that they worked with another law firm, is that, you know, because we're talking about the value of the IP from day one and how it is that we're going to pursue the things that have the most value and not worry about things as much, no way that we're gonna determine that value. And then we throw out things like we know that, for instance, in you know, 2020, that the average value of a patent on the brokered market was 418,000 dollars right, and so let's say that you make an investment of, you know, 25K or something like that, that you're already getting like a 10x on the value.

And that's usually the brokered value is like when you're winding down a company and we're selling off those assets to try to pay back whoever we need to pay. It's not exactly the most opportune time. But even at the low end, it's like a Gaussian curve. So this is the way I describe it in these first calls with people. There's a Gaussian curve. At the bottom of the Gaussian curve, it's like 40K is like the min and then the max is like 1.1. And again, this is all in the brokered market. And without there being evidence of use by someone else, right?

So like if you had some patents where there was evidence of use, then the value increases by like 219% or something like that, right? And so it becomes exponentially higher than what those normal brokered values would be. So just when I say those things to someone like an initial call and they've already spoken with other firms, they're like, we've never heard this before at all. We've never had anyone think of this in any other way besides you give us the engineering information that you have, I'll transcribe it and give it to the patent office and we'll see what they say, right?

You know, we wanna take the information that you have, strategically curate a patent or patent portfolio or strategy, may or may not include a patent portfolio at all. Maybe it includes a trade secret portfolio, ‘cause we don't want it in the public domain, right? But whatever it is, it needs to help drive your business objectives. And then that way it becomes, like what we're, you know, with the Free Zone, since it's the Free Zone podcast, then it becomes like this collaborative experience instead of just me digging in somebody's pockets too, right? The rising tide, you know, lifts all ships, you know, theory, right? And I can tell you, it does work that way. But the big change in the first phone call is discussing the monetary value of patents and then how we're going to use that to accomplish their business objectives.

Dan Sullivan: Yeah, no, what really strikes me is that it's like a dating service, actually. It's just introducing the right things to another right thing without a lot of doorways that you have to go through, you're able to get it. But it seems to me that the more that someone approaches IP, just what is my mindset? I'm thinking about a mindset scorecard of the eight mindsets, that would put somebody in the fourth column right off the bat for you, and I can see, Steve, if we develop that in Free Zone, you know, I mean, Keegan is the, if you got a brand new idea and you wanted to go to the marketplace, his company is like the ultimate shortcut that you would want right off the bat, simply because they're not going to allow you to get in the ditch. And they're not interested in things that don't happen fast. You know, I need my clients to be successful, right?

Keegan Caldwell: So I need them to be successful so that we can also experience success, right? And I know, you know, we've gotten good at it over time where definitely when I was first getting started, a lot of it was just, well, I hope this works out. And there's actually another Coach member, this is worth bringing up too. I'll talk about him because I know he won't mind. There's another Coach member that we did some patents for, you know, and he was one of my very first clients. And we said, hey, let’s create some IP that's directed towards a certain entity that would be interested in maybe buying it. He was thinking about either being acquired or growing towards an IPO.

So we crafted some IP that we knew would be a value for the only company that was really larger than him and his industry. And we ended up selling those patents in a portion of his company for $129 million six months later. Now, what I'm pointing out, though, is that when I was doing this, some of this was faith-based mechanisms with which I was figuring these things out, right? I didn't have all the meets and bounds that I have today.

Dan Sullivan: This was your religious phase.

Keegan Caldwell: Yeah, exactly. Exactly. Like, I didn't let this work. If this works out, you know, I promise I'll be good. So anyways, that model of strategically approaching things, you know, we've been able to repeat several times over, right? And, you know, it's just another example of if you're contemplating how and what it is that you want to do, then you can do that. Like there's a lot of firms out there that do landscape searches and understand the landscape, but how do you create the landscape search? How do you know who the competitors are? How do you know what technology it is that they're going after? And then how is it that we can classify those things so that we can make reasonable decisions about what it is that they're doing and how we can make strategic decisions within our particular industry with CIP so that we can capture as much value as possible. That's where I think the gap is.

Dan Sullivan: Yeah, Steve, what are three things that are ahas for you so far? Because there's a lot of ahas for me that I've gotten from Keegan so far, I'd be happy to …

Steven Krein: So one of them is that I think everything Keegan's done up until now is practice for what he's about to do and he doesn't even realize it. Let that sit for a second, Keegan.

Keegan Caldwell: Yeah, that's probably true.

Steven Krein: I think there is a opportunity for him to democratize a lot of his knowledge and experience and process for a lot of people who need it and don't even realize they need it, or could access it and can get it. And the third is, I think there is woven into your narrative an offensive strategy on patent versus a defensive. And I have a deeper appreciation for, about most people think it's about protecting instead of offensively growing. And I think, and I always have the entrepreneur hat on of health innovators and people trying to really transform healthcare.

And I can't tell you how often the knowledge that you have would be welcome in digestible chunks and digestible strategies and digestible steps that I think is really important for not just value creation, you know, value creation for them, but actually, I think a deeper appreciation for their creativity and innovations. That, like I said, you talk about it being unique, but every one of them thinks it's unique. I think you can offer them some validation of what they're working on. So I have a million more questions I'm looking forward to …

Dan Sullivan: I'd like to pick up on a point you just made. Someone that, all three of us know him as John Farrell, because John was in the Coach 2 Program with Steve. For those who don't know, John was in Strategic Coach for about 13 years, and he's the founder and main partner in Carr/Farrell, which is one of the very, very significant IP firms right in Silicon Valley. I just talked to him constantly. Every workshop, I talked to him about what he was doing. And he developed a lot of his thinking of what he subsequently did by going through processes in Strategic Coach.

And he started creating processes. You know, he had thought in terms of projects, but I said, it's processes that you keep improving through new projects. And one of the things he said that he came to was that if you really want to differentiate yourself in the intellectual property business, you consider the intellectual property from day one as part of the design of the new value creation in terms of market positioning. He said right from the beginning, you use the IP to position your unique monopolistic section of the marketplace. That's what I got from him. And Keegan, everything you're saying resonates with that. Well, you were talking offensive. It's an offensive thing. It's a design element and it's marketing positioning.

Keegan Caldwell: John has some wonderful insights and is a really accomplished, respected guy. And being able to utilize and capture the marketing value of the IP that you have, it becomes part of your company's journey in your story where, let's say that you're a SaaS company. But then this is a great example because I know lots of companies that are SaaS companies that lean into getting an intellectual property portfolio. And then I know other SaaS companies that are like, there's no need for us to do that. We're just really focused on the EBITDA. And as long as we can keep the EBITDA in the margins where we're at, we're going to get the exit that we want. And that's what the VC guys want.

And so if we do that, then it's all going to work out. But I can tell you that the multiple that the guys that have patents on those SaaS companies for their exits are getting is considerably more than what the people that are not getting IP are using. Even for IPOs, Dan, it's an average of 13.9% higher for companies that have IP and an IP strategy than companies that don't, right? And so now you're talking about over nine figures of value that you're adding with a fairly basic, you know, IP strategy generally, right? And so, like you were just saying with John, if you can harness all those things and make it become part of the journey of the story, or even at like the seed level, right?

Let's say that you just got a seed and you're going to raise an A or, you know, you're, you have some rolling round at the beginning or something like that, but you've got this technology that you're saying is so great to everyone. You know, an easy way to say that we really believe in it is that we protected it, right? That we took the initiative to spend the dollars to protect it. It's like a checkbox for early-stage investors, oftentimes, because you've taken the initiative, you know, instead of just being the SaaS company, now you've went ahead and said, no, actually, you know what? We're a technology company, and we're a technology company. We've substantiated that by getting IP that protects the technology that it is that we've created.

Dan Sullivan: It's part of the packaging.

Steven Krein: Great cap off. Did everybody get their insights in?

Dan Sullivan: Yeah.

Steven Krein: Awesome. Well, lots of questions for Keegan Caldwell. Dan, always love these Free Zone podcasts. See you on the next episode.

Dan Sullivan: Thank you.

Keegan Caldwell: Thanks, Steve.

Related Content

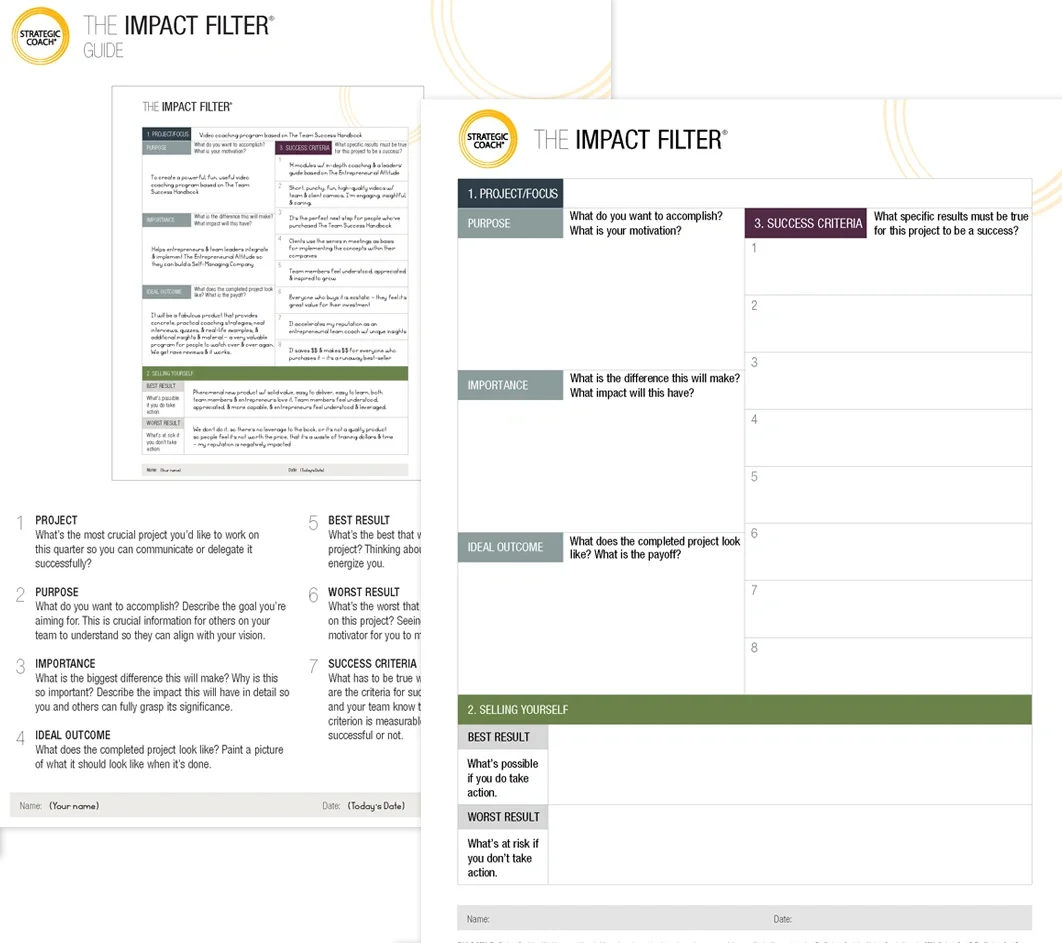

The Impact Filter®

Dan Sullivan’s #1 Thinking Tool

Are you tired of feeling overwhelmed by your goals? The Impact Filter is a powerful planning tool that can help you find clarity and focus. It’s a thinking process that filters out everything except the impact you want to have, and it’s the same tool that Dan Sullivan uses in every meeting.