Turning Tariffs Into Your Unbeatable Advantage

April 22, 2025

Hosted By

Dan Sullivan

Dan Sullivan

Shannon Waller

Shannon Waller

Are you prepared for the biggest economic shift in 80 years? In this episode, Dan Sullivan reveals how the new global tariff landscape creates unprecedented opportunities for agile entrepreneurs. Learn why the post-WWII economic order is over, how to adapt your business model, and why being alert, curious, and resourceful is the secret to success in this emerging era.

Here’s some of what you’ll learn in this episode:

- The real history behind today’s tariffs—and why it matters for your business.

- How WWII transformed the U.S. economy into a global powerhouse.

- Why the U.S. dollar leads world trade (and why that’s changing).

- Why the U.S. Navy started protecting trade routes around the world.

- Five critical strategies every entrepreneur must adopt now.

- A simple framework to help clients regain confidence in uncertain times.

- Why China faces unprecedented challenges in this new era.

Show Notes:

On April 3, the U.S. announced tariffs of 10% for most countries, with higher rates for nations with significant trade imbalances.

Post-WWII, the U.S. economy was self-sufficient, yet other countries charged tariffs on U.S. goods while enjoying tariff-free access to American markets.

One-sided tariffs led American corporations to offshore factories, costing U.S. jobs and prosperity.

Trump’s tariffs are a negotiation tactic to reset unfair trade terms and bring manufacturing back to the U.S.

China’s current trade practices make it the primary target of aggressive tariffs (now 125%).

U.S. companies abroad face tariffs unless they relocate production home—creating a surge in domestic opportunities for entrepreneurs.

You want to be the buyer in every negotiation. The buyer is the one who can walk away from the table.

The United States is the best place to sell a product created anywhere in the world because it has the most customers.

Tariffs aren’t about fairness. They’re about trade.

Entrepreneurs are skilled at responding very quickly to new dangers and new opportunities and developing new strengths in the process.

Global supply chains are fracturing, forcing businesses to source locally and regionally.

During uncertain times, people feel as though they’ve lost their future.

You can help clients and customers rebuild confidence in their future by focusing on their dangers, opportunities, and strengths (D.O.S.®).

The 1945–1992 economic order was a historical anomaly, and we won’t see anything like it again.

AI reduces labor costs (and creates new opportunities for entrepreneurs as a result).

Resources:

Trump: The Art of the Deal by Donald J. Trump and Tony Schwartz

The D.O.S. Conversation® by Dan Sullivan

The Great Meltdown by Dan Sullivan

Never Split the Difference: Negotiating As If Your Life Depended On It by Chris Voss and Tahl Raz

Episode Transcript

Shannon Waller: Hi, Shannon Waller here and welcome to Inside Strategic Coach with Dan Sullivan. Dan, you put together a piece very recently called Free Zone Growth In The Emerging Global Tariff Age. And as we're talking and as this is being released, global tariffs are actually now a thing. But you did a great, as you call it, Perplexity collaboration to give some advice and direction in what I'm calling, it's not so much scary times as uncertain times. And I really appreciate that you actually were super proactive about this, because a lot of people are like, okay, the rules of the game have just changed and they are working to catch up. So let's talk about what is the emerging global tariff age, and then we'll talk about how to deal with it.

Dan Sullivan: Yeah, well, there's a little background to what's going on right now, like something new has just emerged in the world. And actually, there's some historical perspective that's needed. The event, of course, was on April 3rd. The president of the United States, Donald Trump, put out a chart which indicated that the United States, in its trading relationships with the rest of the world, was going to charge tariffs. There was, first of all, it was going to be 10% for all countries. And then certain countries where there's a great trade imbalance between the United States and the other country, he established tariffs of 25%, 35%, and with some of them much higher. This seemed like a bold out of the blue for most countries, but there's a historical context that has to be understood. And you have to go back to the first week of July of 1944.

And I've always had an interest in this because on the first of July of 1944, I was six weeks old. You know, something big happened. Now, I wasn't real aware at six weeks old, I wasn't really aware of what was happening, but it was a point of great interest that this had happened, you know, while I was alive. And what happened was they could tell that the Second World War, the war in the Pacific and the war in Europe was going to come to an end sometime. They didn't know quite, but it was within sight. The war had been devastating to most countries, especially the European countries and other countries in the Pacific area, Asian area. And the United States at that point, in terms of the world economy, the economy of the United States was 50% of the total world economy.

And the United States had grown enormously during the Second World War because creating war materials for the allied countries, the British and other countries, but Soviet Union massively, they had sent enormous amounts of war materials to the Soviet Union. So they began to say, what's going to happen when the war is over? And the one thing that the Americans knew, and I think other countries knew too, that the next big enemy was going to be the Soviet Union. They were allies for the purpose of defeating the Japanese and the Germans, but they knew that the moment that the war was over, there was now going to be a state of war between the Soviet Union and basically the Western democracies.

So they put together a plan, and this seems to be an economic plan, but it was actually a security plan where the United States, first of all, the dollar, the U.S. dollar would become the global currency. The British pound had been the global currency that the most international trades, you need a currency to trade in. And the British pound had been the currency up until then, and the U.S. dollar was by far the strongest currency. And then that the U.S. would massively lend money to all the other countries. The main program was called the Marshall Plan. They just lend enormous amounts of money to countries to rebuild their economies so they could start producing products. It was a real manufacturing age, industrial age, manufacturing age. So these were factories that produced everything that the civilian economy would need.

So that was one thing. And they could send their products to the United States and the Americans would buy the products and they could come into the United States with no tariffs whatsoever, okay, which had been unknown in the world. You always had tariffs. So tariffs were always there. And the other aspect of it, the U.S. Navy, which to this day is the greatest Navy ever, would protect all the trade routes around the world. The British had done some of that, but the Americans were going to make it global. And they did that because the Americans did not want to have a war in Europe where they were sending American troops to Europe or to Asia to fight against the Soviet Union.

Americans don't like their taxpayers coming back in coffins. They don't like their workers, you know, the people who do the work in the United States. And it was all security. The first thing to understand, it wasn't economic at all. The United States did not need the rest of the world. They had their own economy. It went into place right after the war, 1945, mostly 1946, and then it extended all the way to 1992 when the Soviet Union collapsed. It just collapsed because economically it wasn't a feasible country.

Shannon Waller: So Dan, this strategy sounds like was peace through economic growth. Does that make sense? And that was going to be one of the best ways to keep, well, it was a Cold War, but to keep Russia at bay was to actually increase everyone's economic capability. Is that accurate?

Dan Sullivan: With the agreement that that country who was receiving the aid, their attitude towards their own military and their security, that they would be on the side of the Americans' relationship to the Soviet Union. And if you don't understand that, and you don't understand this context, then you don't understand really what's going on right now in the world. And one of the things, when the tariffs came out on April 3rd, I said to myself, and I talked to other people, I said, the Second World War is now officially over, because this whole strategy was just a product of the Second World War and then the Cold War.

Shannon Waller: Soviet Union collapsed in 1990.

Dan Sullivan: It was called the Bresson Woods Agreement.

Shannon Waller: Almost the momentum sounds like it carried it until 2025. Is that right?

Dan Sullivan: That's the whole point. Technically, it should have ended in 1992 that we're not going to do this. But what had happened during those 45 years, whereas the U.S. was not charging tariffs on foreign goods that were coming into the United States, other countries were charging the U.S. tariffs, you know, and that includes Canada, includes the Germans. Most of the countries in the world had charged tariffs. In other words, that we'll take advantage of your no tariffs, but we'll charge tariffs against the Americans selling, you know, American-made products into the other countries.

One of the by-products of that is American corporations started closing down their factories in the United States and moving their factories to these other countries. And then they would make products in these other countries and sell them back into the United States. But American workers got none of the employment. There was no prosperity. And this went on and on and on. And I remember in 1992, when the Soviet Union, without anyone's permission, collapsed, it was like nobody said, this is not a big deal. And the reason is everybody just didn't want the deal that they had with the United States to stop.

Shannon Waller: Well, yeah, protected trade routes were so useful to the world.

Dan Sullivan: Well, and the other thing is no tariffs into the United States.

Shannon Waller: They kind of forgot the deal. Like to be allies.

Dan Sullivan: Yeah. And this was noticed in the 1990s. President Clinton, who came in in ‘93, he was elected in ‘92, and he was talking about it, not in a big way. And Bush, younger, was talking about it. And Obama, there was talk about it in the Obama administration. But Trump, as a businessman, you know, all during that period for the sixties, seventies and eighties, he was saying, you know, there's something unfair going here. But once the Soviet Union collapsed, he, as a businessman, was saying, you know, there's something really, really scurry about this, that we don't charge tariffs, but they charge tariffs. I mean, there were little tariffs on certain things, but one of the things this caused was a huge trade imbalance, that other countries were making money out of American buyers, but the United States was not making money out of selling our products in the other countries.

So Trump brought this up in his first tour, and then he was defeated in 20, but he had four years to really think about it. And he came in and he was talking. I mean, he ran on this. He ran on this in his election. There shouldn't be a secret. He's been talking about this openly since 2016. We've got to rearrange this. And so when he came back into power here in 2025, he said, okay, we're going to do it. That's the background to it. But the big thing about it is the start of a negotiation. And what he wants to say is, let's every country in the world, let's sit down again and bring everything up to date. Okay, so his move about the tariff, the tariff, you know, has taken on an incendiary turn. But what it is, he says, with every country in the world, there's 200 countries in the United Nations, he said, let's have negotiations then, just you and us, and how trade is going to go forward here.

And I just wanted to get your attention with the tariff, and now let's start talking. But a whole bunch of countries immediately put retaliatory tariffs on the United States. And he says, we're not going to talk to you, but all the countries that didn't put retaliatory tariffs on the United States, he says, okay, I'm willing to say there's no tariffs either way, and let's talk. And China immediately put huge tariffs because they're the rogue nation in the world right now. They've never played by anybody's rules. They steal other people's ideas. They're the big enemy. The country, you know, when the Soviet Union collapsed, China becomes the next rogue nation.

So there's sort of an isolating process going on. That's just the background. And that's not really what I wanted to talk about. I want to talk about how entrepreneurs, especially in the countries where our clients are from, this is how you take advantage of this because the world is really going to be changing.

Shannon Waller: And I think the context, Dan, which I really appreciate, because you have such an incredible grasp of how things happen, is really important to know that this has been a long process. If you think about it, a deal was made.

Dan Sullivan: 80 years.

Shannon Waller: 80 years. This is a new deal, right?

Dan Sullivan: It's a new deal.

Shannon Waller: That's important context, because otherwise you're like, what is actually happening? So I think that context is really important. So you have five points in your collaboration with Perplexity. So one, diversification of trade partners. Two, domestic economic adjustments. Three, retaliatory terrorists create local opportunities. Number four, re-evaluation of supply chains locally and regionally. And five, push for private sector-led trade innovation. So let's do a dive into these. Diversification of trade partners. What does that look like? What's possible that wasn't before?

Dan Sullivan: Well, immediately I think what would happen, just as a result, immediately there's been enormous perturbation around the planet. Every country all of a sudden had to rethink their whole future as a result of about a half-hour presentation that the president made. But he's a negotiator, you know. He wrote a very famous book before he became president called The Art of the Deal. And chapter four, he said, when you negotiate, you always start high with your demand or your bid, okay, this is my price. And he says, if you want to get to halfway of that, you have to start twice as high. There's a number and there's a new set of relationships I want.

So you have to appreciate that people say, well, he's just a man. No, no. He's starting a negotiation with you, but it's just with you. Okay, this other country is a different negotiation and there's 200 and he's got all of his negotiators now talking about that. But if you say, well, we're going to retaliate against you, then you're going to go to the back of the line and we're not going to talk to you. We're just going to talk to the people who want to negotiate. So he's creating an entirely new block of countries now that will be in a new economic zone on the planet.

Well, this is going to change trading routes altogether. Okay, so for example, France, Canada immediately says, and they said, okay, well, we're going to negotiate with you later. So for now, the tariffs are there. But you have a choice. If you don't want any tariff, you really want to make us very agreeable. Why don't you move your factories to the United States and produce the products in the United States so that our people get hired? And this will replace the problem over the last 30 years where American corporations were shutting down American factories and putting the factories in other countries and then selling the products back into the US.

So what that means is an American corporation today who is in a country that has retaliatory tariffs against the United States, your products, your American corporation, but your products are going to have a tariff on them unless you return your factories back to the United States. So that's the logic of it. Okay. And the whole point is, and this comes from a previous interview that we did in this podcast series where I said, you always want to be the buyer in any negotiation. You want to be the buyer and the buyer is the one who can walk. Okay. So in any negotiation, the person who can walk from the table and say, sorry, I, we don't want to negotiate any further is the buyer in the situation.

The other person that's out in the U.S. is just announcing to the world that in any negotiation we’re the buyer. And it makes sense because if you create a product anywhere in the world and you want to sell it, the United States is the best place to sell it because it has the most customers. And a lot of people say, well, this is unfair. It's not about fairness. It's about trade. You know, it's about deals and it's about trade. So, my sense is the 20th century just ended and the 21st century actually just began, because for the rest of the 21st century, we're going to be living in the world that was created on April 3rd, 2025. From now on, this is the world. And this is going to happen, and it's unpredictable, and there's going to be all sorts of negotiations, and the mainstream media is going to be writing about this daily for the lifetime of all the people who are living there.

But the big question is, my interest is in entrepreneurs. If this is the new world, and the old rules don't apply anymore, how do you take advantage of opportunities that are taking place in your country? You're in the United States, you're in Canada, you're in the UK, you're in India, they're in Australia. I'm saying I'm just interested that you as an entrepreneur have the ability to respond very, very quickly to new dangers, new opportunities, and you can develop new strengths. You already have existing strengths and you can do it. So I laid out five things we have to respond to, and I've created, how many is it? Three each or?

Shannon Waller: Yeah, there's bullet points. There's three subsections. So the first one is diversification of trade partners. So expand into emerging local markets, leverage regional trade networks, and develop export-oriented products for regional buyers.

Dan Sullivan: Yeah, so basically what was easy to get from overseas before that now has to be produced locally in your own country. From an investment standpoint, you can invest in new start-ups. Or if you're in that business, you can know that you can expand because you're going to have local customers who are no longer being supplied from the outside. It's just very expensive now to bring things in.

Dan Sullivan: So what's the opportunity?

Shannon Waller: To create new things, you know, and every country has its strengths. So what you have to look at is you have to accept the rule that the game has completely changed. It's like a game of Monopoly or a game of Scrabble. When the game ends, all the pieces go back into the box, except this time there's a new game board when you start the new game and there's a new set of rules. But my feeling is that if you're an entrepreneur, you're going to respond to this much more quickly. One new opportunity you have, which is a Strategic Coach strength, is that all your existing customers as an entrepreneur, go out and ask them how they're feeling about all this.

So this is the time for the next month or two is to go out and have breakfast, lunch, and dinner and say, can I ask you a question? What's your future look like? And say a year from now, what do you want your future to look like? And say, what dangers do you have now that you're fearful of and say, so if someone could help you overcome these dangers over the next year, would that be worthwhile? And opportunities, what opportunities do you have? Because they've lost their future. When things get uncertain, people lose their future. They had a future planned, and now that future has disappeared. So help them restore their future.

And if I was an entrepreneur in your situation, I would go out and just talk to all my customers, because they're probably paralyzed. They're fearful, they're paralyzed. Just go out and give them a full hour where they can just talk about their dangers, their opportunities, and what strengths do they have they can maximize. And just having that conversation, they start to create their future again, and you're considered a very valuable person to help them to do that.

Shannon Waller: And you actually said this in the workshop yesterday. I was just pulling out my notes. D.O.S. restores people's confidence in the future.

Dan Sullivan: Yeah, D.O.S., that's what I call dangers, opportunities, and strengths. People have fears because of dangers. They have excitement because of their opportunities. They have confidence because of their strengths. And you have to get them to come back to the president and say, okay, the rules have changed, but these are the cards I have to play for the next year. And if you just did that, one is, opportunities would be given to you. You'll become seen as a useful person. It's amazing. We had a situation in 2008, 2009 when the subprime loan in the United States and the stock market tanked and everything else, and I said to our entrepreneurs, all the entrepreneurs in this Coach program, I said, go out and meet with all your customers and just give them an hour of their time where you don't try to sell anything, but you just ask them how they're looking at their future and get them to set a new future. And every entrepreneur who did that had a really great quarter. People have money, but if you don't have a future, you don't spend your money.

Shannon Waller: So true. One of our last podcasts, we talked about a decision is better than no decision. Even if it turns out to be a bad one, you'll work to make it right. But taking action is so critical in this. And the other word that comes to mind as I'm reading over this that we'll attach as part of the download in the show notes is just being resourceful, like shifting the focus instead of from global to local and regional. You talk about that a lot here, which I think is really interesting. So the winners will be the people who are resourceful, who reach out, create opportunities for other people.

Dan Sullivan: Alert, curious, responsive, and resourceful.

Shannon Waller: Exactly. Yeah, that's how we need to be rather than just frozen and paralyzed, which is how a lot of people seem to be responding. Dan, your second point is domestic economic adjustments. So create substitute products locally, capitalize on private investment opportunities, and promote local sourcing partnerships. Tell me a little bit about those. There's an adjustment, definitely.

Dan Sullivan: Well, I think the big thing is because things that you're used to coming in from halfway around the world that cost very little. One, they're not coming. That's one problem. And the other thing is they cost way more than they did before. So it's possible now for local and regional companies to become the suppliers. And this requires all sorts of new forms of transportation and new things. So what's going to happen with the countries that respond really well to this, their national economy is going to become more autonomous. Or new trade routes are going to be created. There's going to be countries that say, we're not going to play the tariff. So for you, between us, there's no tariffs. So that's a new trade route that comes over.

But the real country that's going to really have a hard time with this is China, because they've been predators in the global market. What they do is that they don't have a normal economy, like we have an economy that's independent from the government. Almost all the countries, United States, Canada, it's influenced by the politicians, but the politicians don't have control over the economy. In China, the economy is just the political arm of the government. They move money around, so they'll pour money into a product, and they can drop the price of the product and then sell it into a foreign market, and they can destroy the producers in a foreign market, and then they get a monopoly over that market. And they've been doing this ever since they were allowed into the World Trade Organization 30, 40 years ago, and they've been nothing but predatory since they came. So a lot of things come very, very cheap from China.

What's happened right today as I'm making this, the tariff against all Chinese goods is 125%. Okay, so it's twice as expensive and then a little bit more. And so things that you used to get from China and that was very cheap and there were no competitors, now it's going to be very expensive and there's going to be competitors in new countries now are going to be producing products that used to come from China. And they're the main focus here, as the Soviet Union was the focus for the Bretton Woods agreement. China is the new because they don't like playing by the rules.

Shannon Waller: Yeah.

Dan Sullivan: And if somebody doesn't play by the rules, you can't have a good game. So the rules are going to change. And I think that all entrepreneurs have to become enormously alert about some subjects that they haven't really paid attention to. And one of them is what's the tariff situation? This is going to be your new PhD or an entrepreneur is to understand we're living in the world of tariffs and it's not going to end. My sense is that there's not going to be again in history the situation that we had from 1945 to 1992. That was a once in history situation and we're not going to see it again. So you have to pay attention to what your country's relationship is with other countries and where the opportunities are there.

Shannon Waller: It's interesting because, you know, you turn me on to Peter Zion and he's been predicting the end of China because of demographics to a large extent.

Dan Sullivan: And for exactly this reason too, yeah.

Shannon Waller: And it's interesting, this will just exacerbate the situation as far as I'm concerned.

Dan Sullivan: Sort of speed up crises in that area. Yeah, 100%.

Shannon Waller: I just want to echo this. Basically, we've got Trump's playbook from his book, The Art of the Deal. Basically, he's kind of outlined a strategy, and that's exactly what he's doing in politics, which is interesting. It's transference, but it's the same strategy and the same approach. So thank you for that. I did not know that.

Dan Sullivan: Yeah, it's fascinating. There's a lot to learn right now. The other thing is, something unique has happened just in the last three years, and that's the emergence of artificial intelligence. And why that's important, because there are four costs that every economy has to deal with and every company inside an economy. And the first one is, what is the cost of money? And what are interest rates? Because you have to have capital to expand economic activity. And a lot of that capital has to come through borrowing. So what is the cost of money? The other thing is what is the cost of energy?

And here there's vast inequality in the world. And the U.S. by far has the lowest energy costs in the world. So if you're not in the United States, it makes sense for your country to have a really positive relationship with the United States, because the energy costs in the United States are so much lower that if you have really good deals with the United States, then you do it. The other thing is the cost of labor, how much is labor. And if you have an aging population, you have fewer of your population who are in the 20 to 50, that's the sweet spot. And the United States has enormous population between 20 and 50.

One of the things, if you're in these other countries, start having babies again. For most of the world, they stopped having babies 40 years ago, because people who lived in cities, where they were on the farms, they moved to the cities because that's where the high-paying jobs were. But the problem with cities is that you're living in small spaces, and on the farm, children are very valuable, but in the cities, they're expensive furniture. There's a furniture that on average cost you $200,000 until they're 18 at the lowest cost. So there's all sorts of social changes. There's all sorts of relationship changes.

But as an entrepreneur, you're in the best position of anyone in your country to actually think through the future because you can make decisions and you're used to being useful. Now you have to be useful in new ways. But bureaucrats who are in big corporations, bureaucrats in government, that they don't have the ability to adjust the way you do. So I think it's gonna be an age of entrepreneurism that the risky part of the economy, I mean, people used to say entrepreneurs, it's the risky part of the economy and civil service and being a government employee, that's the safe, this is gonna change. So I see a vast increase in entrepreneurism, especially now assisted by artificial intelligence, because one of the things you can do with artificial intelligence is lower the cost of labor.

Shannon Waller: Right, you talk about technology as automated teamwork, which is brilliant. And having used Perplexity, ChatGPT and a few others, oh my gosh, it's like one of the best teammates I could ever have.

Dan Sullivan: Yeah, I have a teammate that saves me 10 hours a day, just with artificial intelligence. So my sense is, that it's not accidental that artificial intelligence came during this period because I think the unrealistic quality of the world situation because of the unfair trade practices was forcing a new capability. I think that breakthroughs like artificial intelligence happen because there is a massive need for some new kind of capability that will lower the costs of money, energy, labor, and transportation. Transportation is the fourth cost. And transportation is going to cost a lot more if you have to bring things halfway around the world. So people are going to shorten their supply chains so the cost of transportation is not so high.

Shannon Waller: Well, and that's actually point number four, re-evaluation of supply chains locally and regionally. I'm in Canada, you're currently in Chicago at the moment, but it's interesting because I was talking to one of our clients in Chicago, but he was based in Canada and he goes, yeah, I'm fine, right? Like the arrangement that he has with the countries that he's importing from don't have retaliatory tariffs with Canada. Other trade routes I think will be strengthened because it's been a very U.S.-centric trade hub in terms of the world. And now it'll actually strengthen all of the other routes is what I'm seeing country to country.

Dan Sullivan: If you have intelligent negotiators, you know, I mean, yes, I think being a negotiator is going to be suddenly a really important skill, professional skill. Chris Voss is going to be very, very happy with this world.

Shannon Waller: Never Split the Difference. Brilliant, brilliant book. Yes, I use it all the time. I skipped over number three, so I want to go back to that. Retaliatory tariffs create local opportunities. You said target tariff-free regional buyers, innovate around disruptions locally, and build strategic alliances within your region.

Dan Sullivan: I would say that every entrepreneur can do an immediate inventory, what part of my cash flow is threatened by tariffs, you know, like is your life threatened by tariffs, you know, because that's a problem that you have to get on to right away is to lower your susceptibility to being blindsided by a tariff. Everybody thinks of warfare as military warfare. This is economic warfare.

Shannon Waller: Yes, it is.

Dan Sullivan: People say, well, we don't want a third world war. But I said, what if we're in the third world war, but it's not taking the form of bombs? And I mean, they're there as enforcers. But I think that basically we're now into the realm of economic warfare. And my feeling is that because of the 50 years of the growth of electronic technologies and microchip technologies and now artificial intelligence is that the response time can be instantaneous. You can change policies very quickly and you can know about things instantaneously in a way that was not true, you know, 50 years ago or 80 years ago.

Shannon Waller: Interesting, Dan, and I hadn't put this together until this second, but you can use AI, and especially a research-based one like Perplexity, to go in, find some of these local regional partners. You know, you can go exploring relatively quickly.

Dan Sullivan: Everything that's on the internet, you can know about in seconds.

Shannon Waller: Which almost everybody is, unless they're an artisan, but even them, they're on Etsy. So yeah, you actually have the resources you need to be resourceful and to be alert.

Dan Sullivan: My sense is that there's whole branches of the stock markets that have already factored tariff into everything. I know the stock market is just instantly upgraded tariff-safe and downgraded tariff-threatened stocks. Every stock in the world just got recalibrated.

Shannon Waller: There is so much of America, I think of American technology, like my iPhone, where so much of it is sourced from China. So it's, you know, a lot of our technology is going to get a hell of a lot more expensive, which is really interesting. So there's definitely, I would, hopefully it's short-term pain for Americans and offshoot of Canadians too, with some of these changes. I understand kind of the, most of the why behind it, but there is definitely a huge need to be resourceful because things are going to get more expensive for a while.

Dan Sullivan: Yeah, my sense is that there will, like during wartime, you know, there was rationing during the Second World War. First World War II, there was rationing. Every war, there was rationing because normal courses of business get interrupted, but you never get anywhere by being defensive in a period like this. And entrepreneurs are trained to respond very, very quickly to new situations. It's been building for a long time, but I think you're going to see a real upshot in the inventiveness of entrepreneurs, in the collaboration of entrepreneurs in a way that you've never seen before in history.

Shannon Waller: And I would add resourcefulness to that.

Dan Sullivan: Resourcefulness.

Shannon Waller: Exactly. All right, Dan, last point on this, push for private sector led trade innovation. Kind of what you've been saying.

Dan Sullivan: Yeah, I think the problem is that for the most part, the business of trade between nations has been very political. And for that sake, it's been very bureaucratic, that with communications being what they are now, that it's possible for private sector people, entrepreneurs, to do all sorts of collaborations and deals that would be invisible for government. They wouldn't even know that they were happening.

Shannon Waller: There's some great suggestions here. Lead private sector solutions, like creating a 50-member tech CEO alliance to standardize cross-border e-commerce practices, fund a research lab, host quarterly innovation summits. The collaboration is amazing. Build multilateral bridges, dominate niche markets. I mean, these are great suggestions.

Dan Sullivan: Yeah. And none of this has to be organized by government. This is just individuals self-initiating. You know, you're just initiating that thing. And I think the role of government is going to change drastically. I think governments are going to be much smaller. I think artificial intelligence can replace 50 to 100 bureaucratic jobs, you know, and everything. I think the highest unemployment sector going forward is actually going to be laid off civil servants.

No, I mean, the United States, you can see it's been happening. There'll be hundreds of thousands fewer federal government employees just in the first 12 months of this because, you know, having meetings, the meetings can be done electronically now, you know. So I think there's going to be big jumps in productivity, big jumps in innovation and everything like this. But if you're depending on big institutions protecting your future and giving you direction, I think that's going to be lacking.

Shannon Waller: Mm-hmm. Dan, you end up this document, which again, we'll include in the show notes. You say, this is your moment. Tariffs didn't close doors. They reveal better ones. Outthink bureaucrats. Outmaneuver giants. Outbuild everyone. Start now. The global tariff age is not a threat. It's your opportunity to redefine success. Yeah, it's very encouraging what you're saying, but basically also get in motion, don't stay frozen, deal in a good way with what's going on. Sounds like there's a lot of opportunity to lean into and to create enormous value for the people, to lower the MELT costs that we've talked about, and to kind of embrace this rather than resist it.

Dan Sullivan: Yeah, and I would say young people who are in their teens is make your learning and your training and your education about something that's really useful and not theoretical. I think it's going to be a period like if you're an 18-year-old and you go to a community college and you take a 10-week welding course, you'll make $60,000 at the end of your first year. Okay, you know, if you're taking some very theoretical program at a university, you won't come out of university with a skill that's really needed during this age. And you may have a huge debt as a result. So I think parents right now, regarding their education and training of their children, I think we're going to shift significantly in what constitutes the kind of skills that young people should be learning and practicing. I think a whole age, I mean, is going to be a thing of history. We won't be in that age anymore.

Shannon Waller: It's interesting, Dan, we are 50 years from during what you described as the last great crossover, which was really microtechnology. And it feels like we're starting a new one, which is kind of artificial intelligence. Artificial intelligence, and then also the end of globalization and the start of, we don't have a name for it yet.

Dan Sullivan: It was just a period of history, and it served a particular security purpose. It wasn't about economics, and it ended, and now it's a totally new situation.

Shannon Waller: Well, as you said, the pieces have gone back into the box, and it's a whole new game board. And I think the sooner people realize that and come to grips with it, the more effective, powerful, productive and contributing they'll be. So I appreciate your perspective. I may not like everything I'm seeing or hearing, but I think you've given an enormous amount of direction about how to be capable and creative and contributing in this time of disruption. So thank you, Dan. Awesome.

Dan Sullivan: Thank you.

Related Content

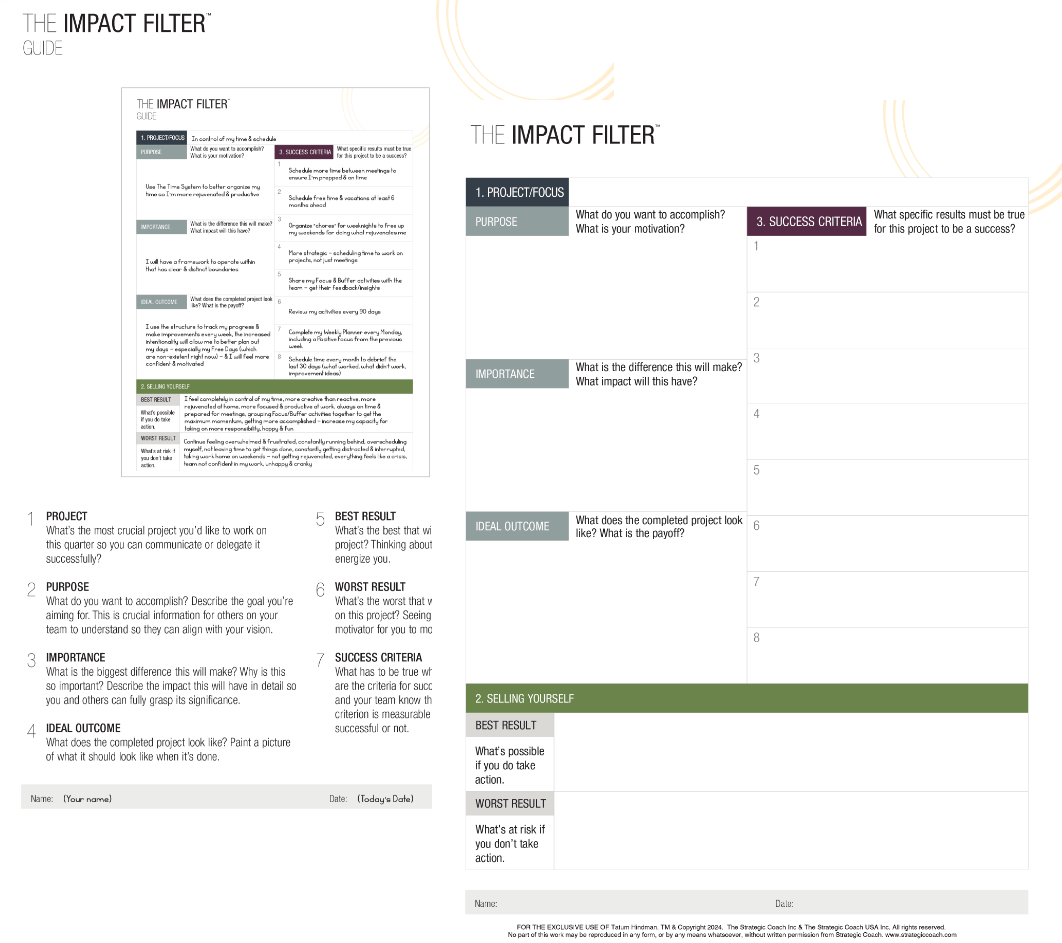

The Impact Filter

Dan Sullivan’s #1 Thinking Tool

Are you tired of feeling overwhelmed by your goals? The Impact Filter™ is a powerful planning tool that can help you find clarity and focus. It’s a thinking process that filters out everything except the impact you want to have, and it’s the same tool that Dan Sullivan uses in every meeting.